全实战进阶系列-CTA策略, 平台小鹅通,by 用 Python 的交易员

BoolDemoStrategy

BollDemoStrategy,一个跑在 15 分钟 K 线上的策略

策略参数变量定义

1 | class BollDemoStrategy(CtaTemplate): |

开平仓逻辑

1 | def on_15min_bar(self, bar: BarData): |

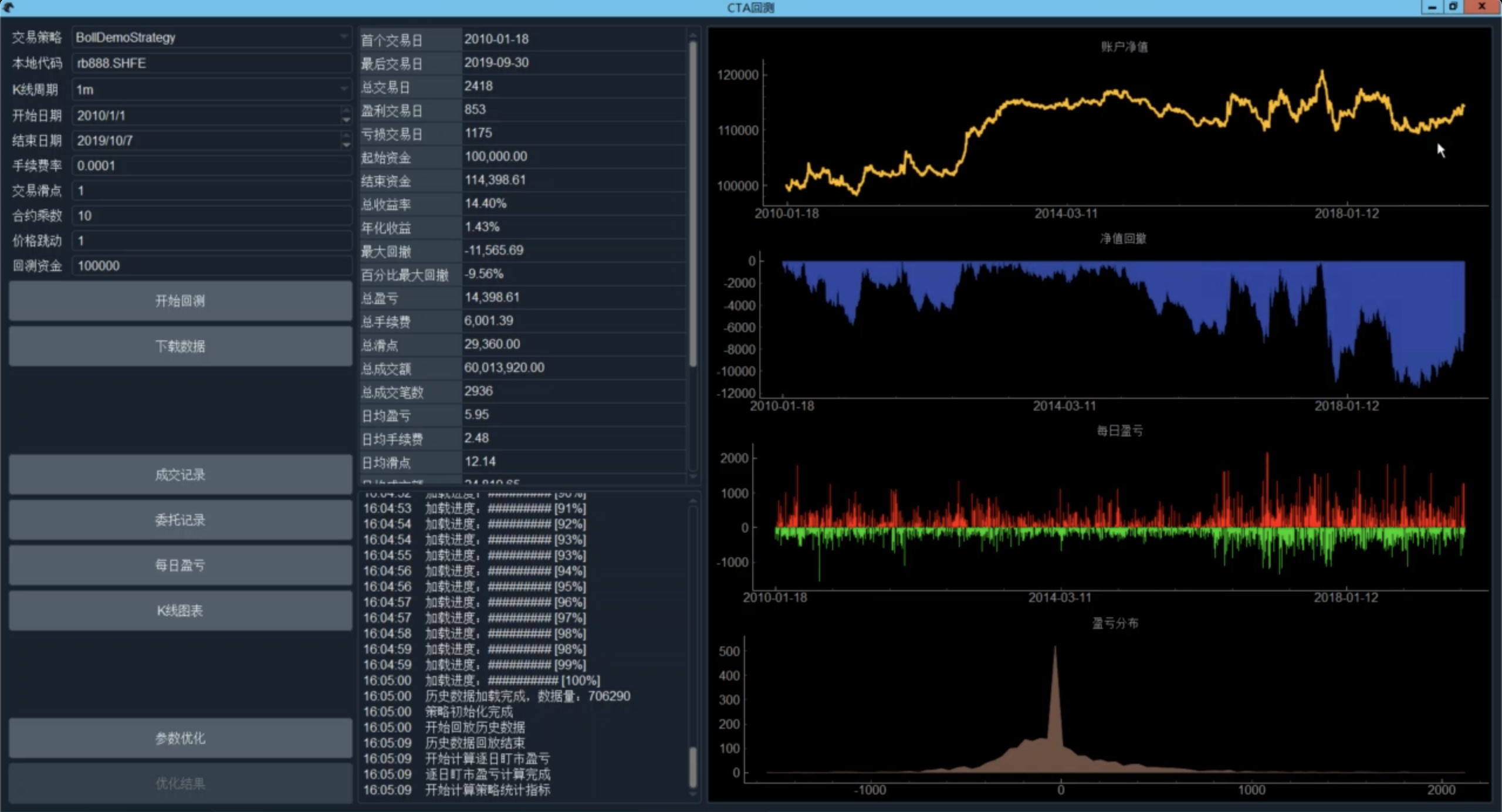

回测结果,不太好

固定价格止损

添加参数

1 | class BollDemoStrategy(CtaTemplate): |

在下单逻辑中加入止损

1 | def on_15min_bar(self, bar: BarData): |

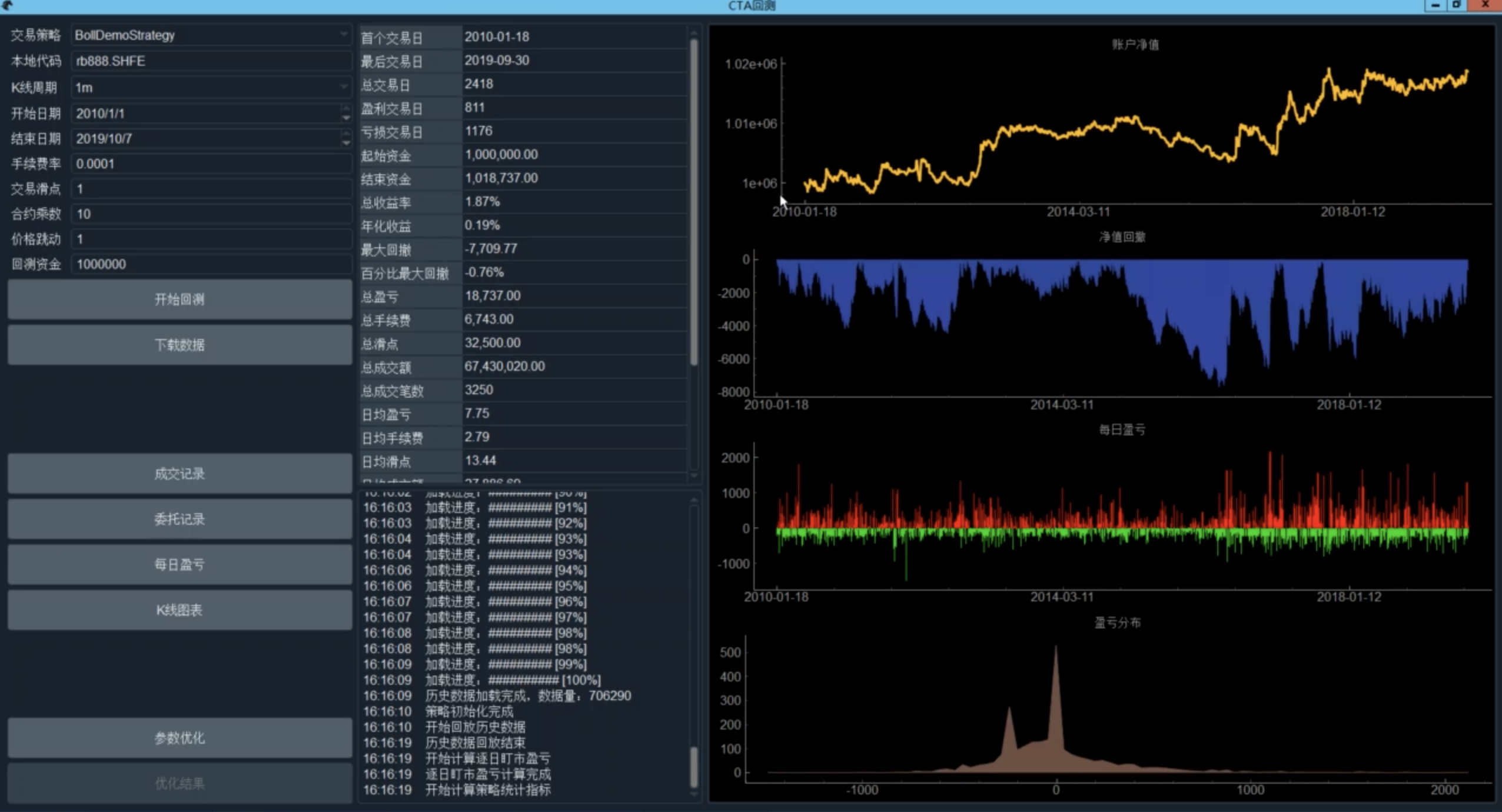

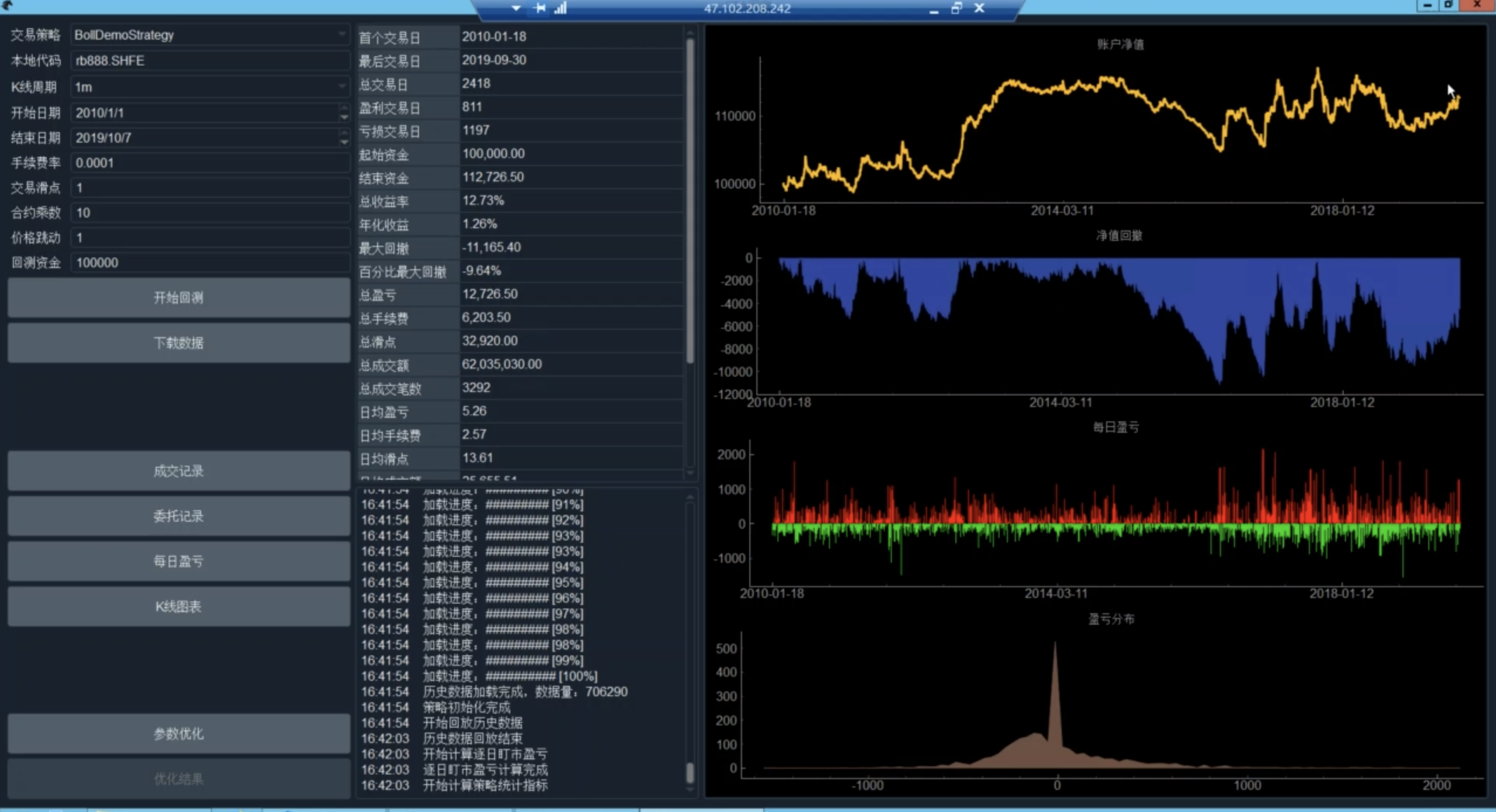

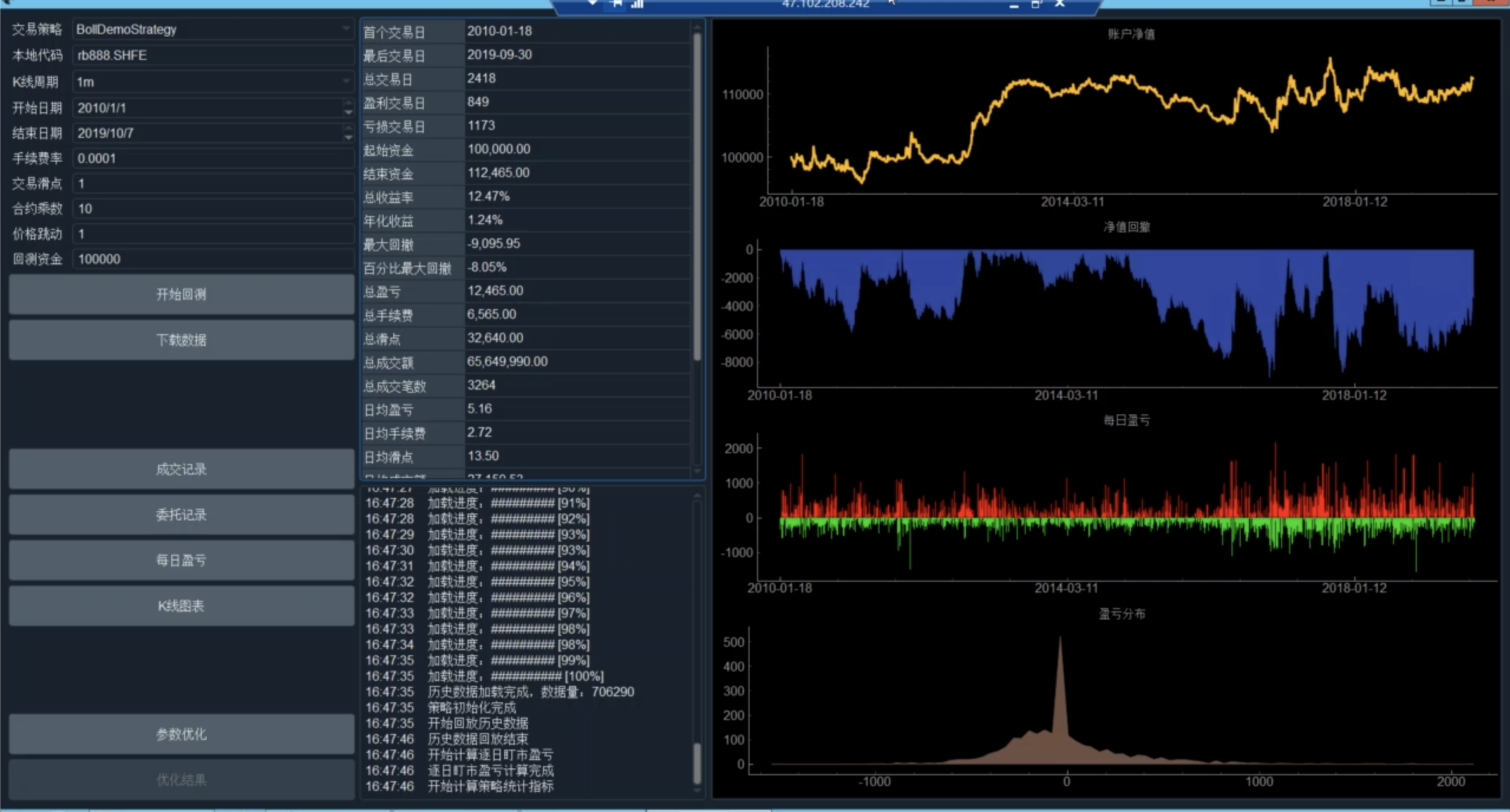

加入止损后,回测结果有所提升

可变止损

按百分比止损

替换

1 | fixed_sl = 20 |

为

1 | percent_sl = 0.01 |

开平仓相应的替换

1 | self.long_sl = self.long_entry * (1 - self.percent_sl) |

按技术指标来止损

使用 atr 的一个倍数止损

在最原始的 boll 策略的基础上,添加参数

1 | class BollDemoStrategy(CtaTemplate): |

对于下单逻辑, 计算 atr

1 | self.atr_value = am.atr(self.atr_window) |

止损逻辑替换为

1 | self.long_sl = self.long_entry - self.atr_value * self.atr_multiplier |

移动止损

根据当前K线的最高价,不断调整止损点位

定义参数的变量

1 | class BollDemoStrategy(CtaTemplate): |

下单逻辑

1 | def on_15min_bar(self, bar: BarData): |

止损进阶

整合多个出场价格,锚定真实的开仓价格

定义变量和参数

1 | class BollDemoStrategy(CtaTemplate): |

收到成交回报,计算止盈点位

1 | def on_trade(self, trade: TradeData): |

下单逻辑

1 | def on_15min_bar(self, bar: BarData): |